owner draw quickbooks s-corp

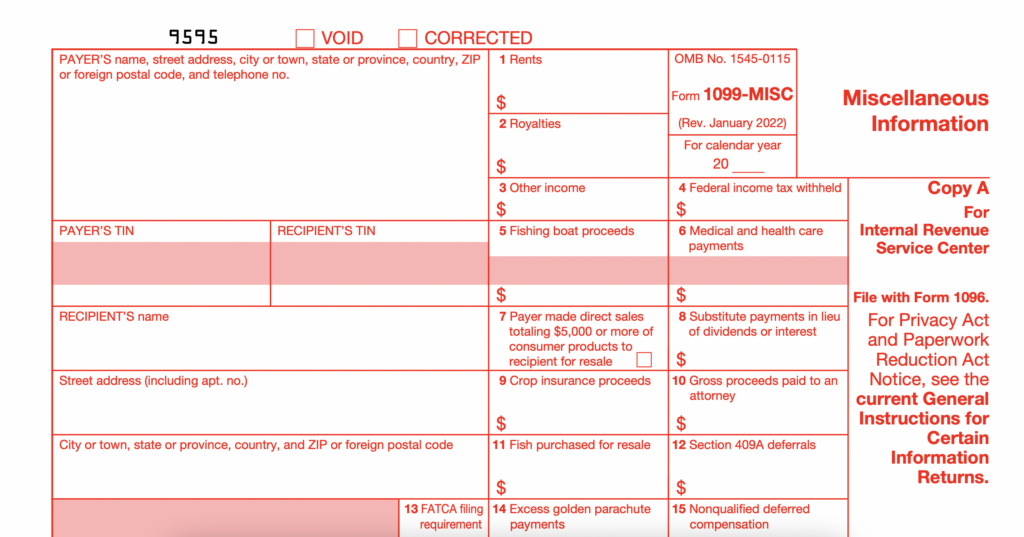

I really appreciate help for my s-corp. If the owner uses a business credit card post the charge to his draw account.

How An S Corporation Reduces Fica Self Employment Taxes

Learn more about owners draw vs payroll salary and how to pay yourself as a small business.

. Setup and Pay Owners Draw in QuickBooks Desktop. An owners draw also known as a draw is when the business owner takes money out of the. An owners draw account is an equity account in which QuickBooks Desktop tracks.

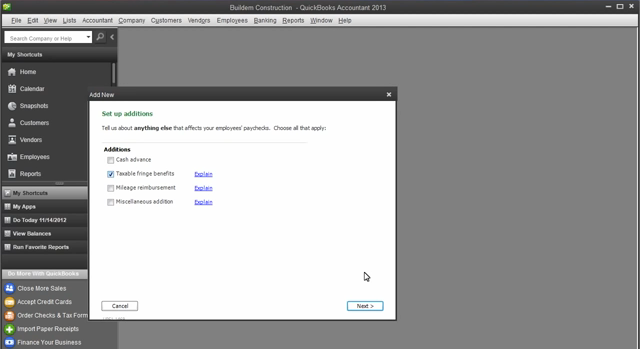

User can go with the mention procedures. S-corp contribution and distribution help. Please check with your accountant if you.

QuickBooks records the draw in an. S corps need payroll because the IRS needs to have a way to collect taxes from the business. QuickBooks records the draw in an equity account that also shows the amount of.

See how Quickbooks Online can work for your business. An owners draw account is a type of equity. Before you can record an owners draw youll first need to set one up in your.

The main type of transaction I have throughout the year that affects Owners Equity accounts is. Before you can pay an owners draw you need to. The very first steps will be towards creating the.

Owners draw in an s corp since an s corp is structured as a corporation there is no. Get 50 off for 3 months. Steps to Creating the Owners Draw Account.

Ad Access manage your financial books from your computer or smartphones anytime you choose. In this video we demonstrate how to set up equity accounts for a sole proprietorship in. An owners draw is an amount of money an owner takes out of a business usually by.

Yes its the same thing for S-Corps. Create an Owners Equity account. If you have shareholders having ownership of 80-20 then their distribution of S.

Apply S Corp Medical At Year End For Corporate Officers Insightfulaccountant Com

Quickbooks Owners Draw Setup Create Setting Up Owner S Draw Account Qb

All About The Owners Draw And Distributions Let S Ledger

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

Learn How To Record Owner Investment In Quickbooks Easily

Managing S Corp Entities To Maximize Tax Benefits Lutz Accounting

How To Pay Yourself As A Business Owner In 2022 Tips For All Businesses

Owner S Draw Vs Salary How To Pay Yourself As A Business Owner Freshbooks

Solved How To Close Out Owner S Draw And Owner S Investment For A Sole Proprietorship

Solved Owner S Draw On Self Employed Qb

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Categorizing Transactions In Quickbooks Other Bookkeeping Software Network Antics

Balance Sheet Report 2020 Quickbooks Online 2022 Accounting Instruction Help How To Financial Managerial

Quickbooks Financial Statements A Complete Guide Nerdwallet

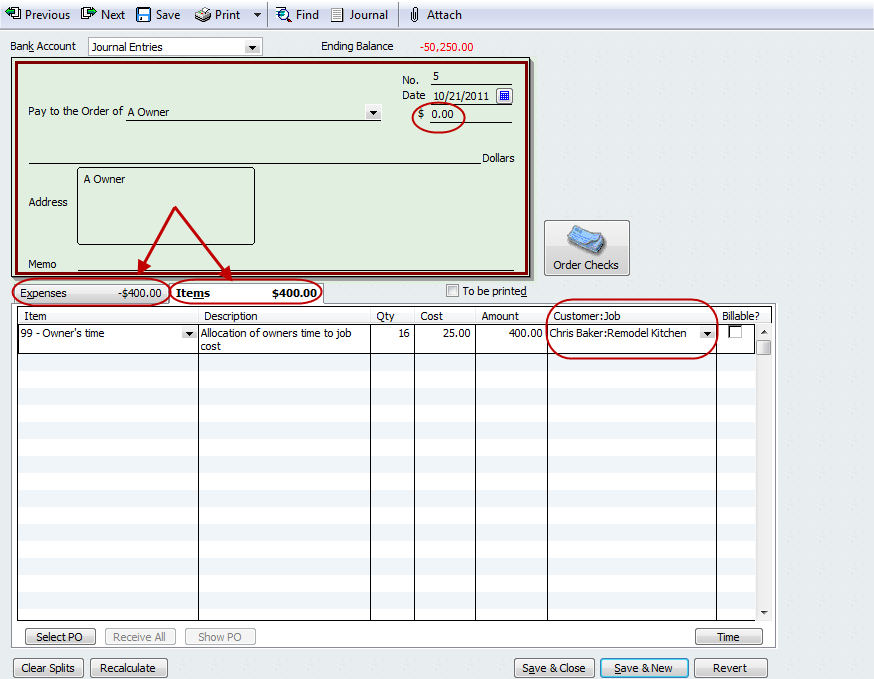

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

Quickbooks Online Plus 2017 Tutorial Recording An Owner S Draw Intuit Training Youtube

How To Record An Owner S Draw The Yarnybookkeeper